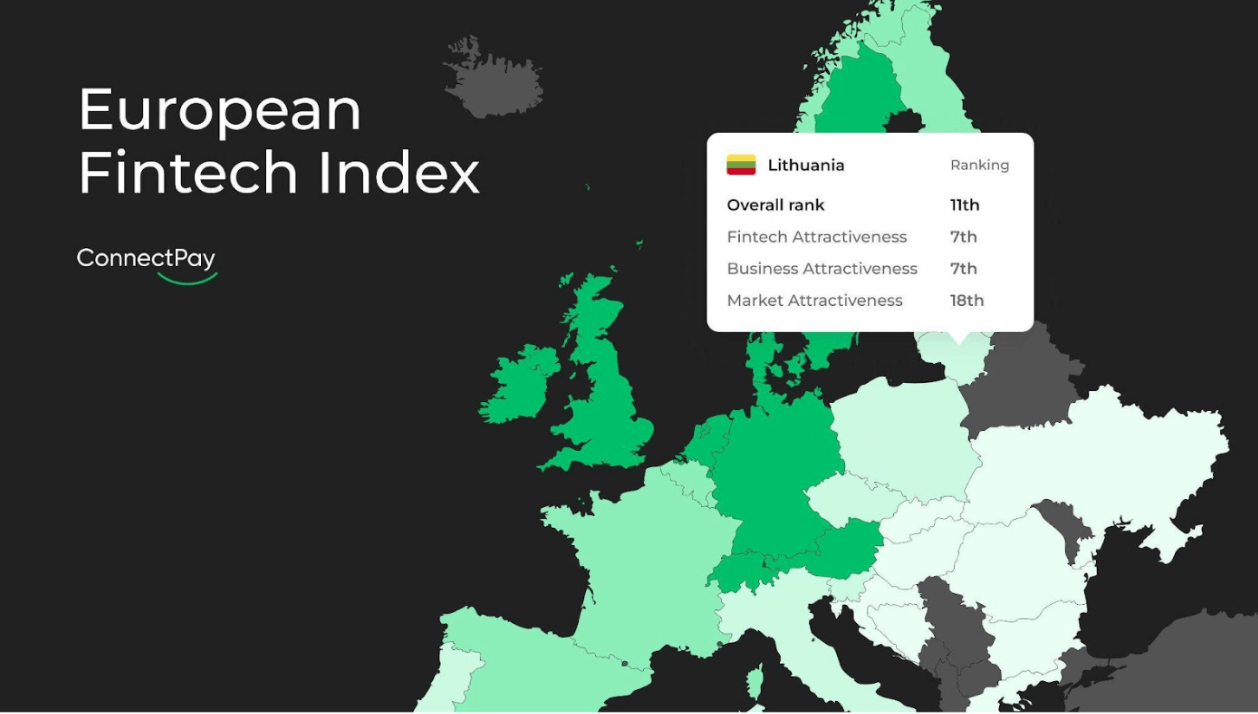

The EFI analyzes markets through three dimensions: Business Attractiveness, Market Attractiveness, and Fintech Attractiveness, which reflect key strengths and potential areas of growth for fintech ecosystems of 32 European countries. Prior to EFI, the latest data set about the Fintech industry was presented by the World Bank in a form of Global Findex Database, however, it has not been updated since 2021. According to Marius Galdikas, CEO of ConnectPay, EFI can serve as a valuable decision-making tool of latest data for all interested parties, as users can pick out and compare the data most relevant to them in an interactive data map.

“Currently, only a third of all countries use sources newer than 2021 when presenting their fintech ecosystem, which limits the option to objectively compare fintechs across different European countries,” Galdikas stated. “The Index provides an unbiased view of the data on fintechs. Combined with the option to filter data based on case-by-case relevance, it enables decision-makers on any level — fintechs, investors, or regulatory authorities — to make data-backed choices that could lead to greater industry growth.”

The overall rankings of the EFI may be surprising for some. For instance, vibrant fintech hubs like the United Kingdom and France are positioned 9th and 10th overall. On the other hand, smaller countries like Estonia and Luxembourg rank 4th and 5th respectively. More interesting facts can be uncovered by further analyzing the study data, which can be accessed through the Power BI tool embedded in the EFI website.

The EFI also points out the issue of inconsistent definitions of “Fintech” across the industry. For instance, Eurostat and the European Banking Authority (EBA), each have their own definitions of what a “fintech” is. According to Galdikas, varying definitions impede accurate tracking of industry’s progress and hopes the EFI will help raise relevant discussions.

“It’s more of a question of what should still fall under the term, and what should probably be omitted. Some rankings go as far as including pension funds, which can potentially skew market data when analyzing fintechs in particular.”

If there will be industry interest and demand for such data, the project might become an annual initiative, however, it primarily aims to continually refine and update its methodology to remain relevant and valuable. To this end, following the launch of the EFI, market experts will be invited to provide insights on improving and enhancing the Index.

“The contribution of experts will be essential to the success and possible growth of the European Fintech Index. In any case, sparking more conversations that could increase market transparency, specify the definition of fintech and help track the progress of the industry would already be a great success,” Galdikas said. “Besides, by sharing ideas and insights we could reflect on, we might expand the Index in the future, making it an even more in-depth and dynamic market analysis tool."

ConnectPay is an all-in-one financial platform for online businesses, offering embedded financial solutions with built-in compliance. Its wide range of modules include SEPA and SWIFT payments, multi-currency IBAN accounts, wallets, Banking-as-a-Service, white-label debit cards, and merchant services. All processes operate via a fraud prevention and compliance management ecosystem that includes KYC verification and AML/CTF monitoring. A smooth onboarding process, customized client solutions, and a single set of APIs enable businesses to utilize innovative payment solutions to meet the needs of their digital customers. ConnectPay holds an EMI license, issued by the Bank of Lithuania, and is a member of the monetary authority of the Eurozone.